By Muhammad Armaghan

When having 600,000 paying customers is NOT enough

Office space sharing was once a great idea.

I can even say the idea was an industry disrupter, similar to Airbnb for hotels and Uber for taxi services — and you would NOT question my judgment.

That is exactly what everyone thought when WeWork came to light. Companies like Fidelity, JP Morgan, and Goldman Sachs had invested billions until 2017 in the company that promised to change how office spaces worked forever.

Then, in 2017, there was the crazy bet Softbank decided to put on WeWork, a $20 billion investment that could not be justified even back then — Forbes calling it a “$20 billion office party.”

It was ludicrous because, that day, WeWork was now worth about the same as hotel operator Hilton Worldwide and more than social media sensation Snap.

I moved to Canada early last year.

I had high hopes to start my new life here, but I didn’t realize before moving that the rents were going insane in Toronto. So, after getting a smaller-than-expected apartment, I decided to look for coworking spaces to start my work.

At $25 for a day pass, I booked a WeWork space in downtown Toronto. Not bad at all for the price. I ended up going there for several days, and on most days, it was mostly empty. Most of the companies still had work-from-home implemented.

Obviously, at the time, I didn’t read into it a lot, but even then, I was impressed with the quality of the space, its features, and its location. We are talking about downtown Toronto, one of the most expensive places in the world for real estate.

I wondered how they were keeping the place afloat, given that even on the most busy of days, the place was half empty.

Beginning of the end

WeWork has always been the darling of venture capitalists and angel investors. With the investment from Soft Bank, the company was ripe for the IPO.

After all, it was making billions in revenue.

The problem was it had an upside-down business model. WeWork’s business model, though innovative, had a fundamental flaw — it prioritized revenue over profit.

This pitfall isn’t unique to WeWork; many startups fall into this trap. The appeal of large revenues can sometimes overshadow the importance of a sustainable, profitable model.

PR Nightmare

This became a PR nightmare as soon as WeWork decided to go for an IPO for new financing options. The decision brought more scrutiny of the operations and governance of the company.

After attempting to go public, WeWork faced a rapid downfall. The CEO, Adam Neumann, stepped down within weeks, and the company’s anticipated valuation dropped dramatically, leading to the cancellation of its IPO.

This downturn was amplified by the release of information that showed WeWork’s considerable financial losses, overambitious market estimates, and a peculiar company culture heavily influenced by Neumann’s unique viewpoints.

While doubts about WeWork’s business model had existed since 2015, newer revelations about Neumann’s potential conflicts of interest added fuel to the fire. Despite prior skepticism from financial experts about its valuation and strategy, the public outcry became the final straw, leading to SoftBank taking over WeWork at a significantly reduced valuation.

Once pegged to be a $47 billion company, it lost 80% of its worth with the scandal.

Revenues, but no cash

WeWork, a shadow of what it used to be, continued making billions in revenues, but COVID-19 came. The pandemic hit its financials pretty hard. As more people started working from home, the revenues suffered, and so did the net income.

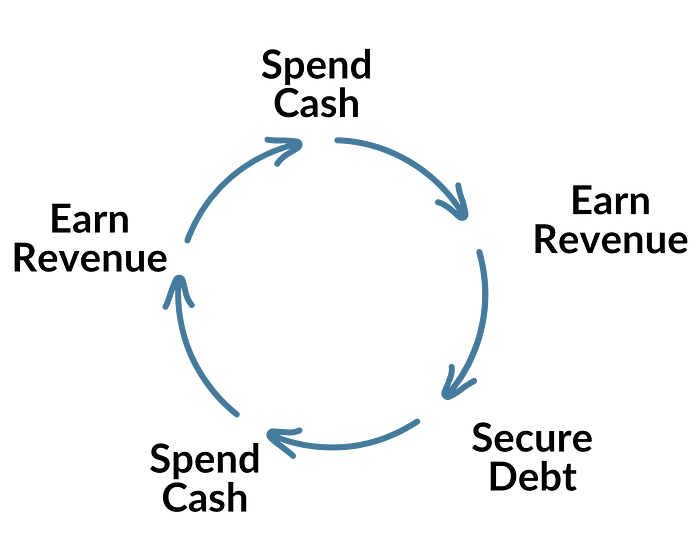

When the Company made billions in revenue, it spent more to keep that revenue coming in. With new office buildings, renovations, and expansion, the costs continued to increase. Every time they would run out of cash, WeWork would get more debt to finance their operations.

The cycle was simple for the WeWork management.

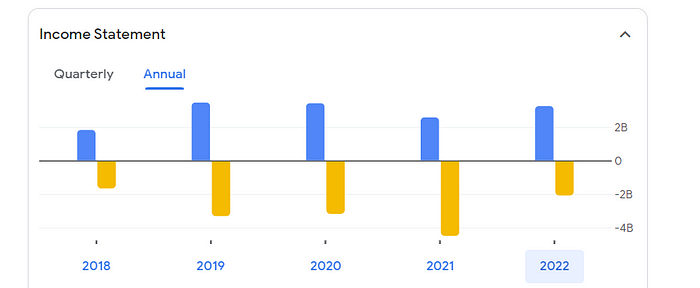

Income Statement Overview:

- In 2022, WeWork reported a revenue of $3.25B, marking a 26.26% increase from the previous year.

- However, this increase in revenue was shadowed by a net income loss of -2.03B, a significant 54.18% jump from the previous year.

Cash Flow Insights:

- Cash from operations stood at a negative $733.00M.

- Net change in cash was a worrying -$636.00M, reflecting a staggering 885.19% year-on-year decrease.

The cash being generated from operations was not enough to keep the company running. But the “vision” WeWork had sold somehow continued to bring in new cash.

If you look at the statements objectively, there is no way WeWork can survive, at least not in the way it is operating as of now.

The calls of being bankrupt have been associated with WeWork for a while. They have always managed to negotiate and extend their life in the past.

But this time, it’s different.

In August, WeWork experienced a major reshuffle in its board following the resignation of three directors due to significant disagreements over board governance and the company’s strategic trajectory.

As a response, four new directors specializing in extensive financial restructuring were onboarded. These newly appointed members have since been in continuous negotiations concerning a restructuring blueprint, especially in the face of the impending bankruptcy.

Despite public statements about its health, WeWork acknowledged significant operational issues. There was “substantial doubt” about its ability to continue, a statement that sent shockwaves through the industry.

WeWork, despite boasting an annual revenue of $3.25B with 600,000 customers in 2022, was bleeding money, with losses amounting to $2B a year.

The primary issue? Revenue doesn’t equate to profit.

The Pandemic Trauma

I don’t know if WeWork would have somehow miraculously survived if the pandemic had not made us realize that we can work productively from home as well.

The commercial real estate across all the major cities in the world is in a mess right now. Companies are forcing employees to be back in the office so that they can justify the real estate costs. But, it has been a slow process.

This has meant commercial office space hasn’t made a comeback. The big boys like Fortune magazine and The Atlantic have openly said that the next financial crises would come from commercial real estate.

So yes, maybe WeWork would have survived if this was a world like 2019. But these ifs and buts do not work now. The reality is that the pandemic happened, the costs increased, demand for office space decreased, and WeWork died.

Rest in Peace

Now, after all the ups and downs, WeWork is expected to file for bankruptcy possibly as soon as the coming week. This represents a significant shift for a company’s fortune.

Securities filings revealed that, as of June, WeWork operated 777 establishments spanning 39 countries, with 229 of these being in the U.S. The company’s upcoming lease obligations, starting from the latter half of this year till 2027’s end, are approximated at $10 billion. An additional commitment of $15 billion is projected to commence in 2028.

On October 2nd, WeWork defaulted on interest payments to its bondholders, triggering a 30-day grace period to reconcile the payments.

An event of default will be constituted if the company fails to fulfill these obligations. However, on a recent Tuesday, WeWork announced an agreement that grants them an additional seven-day window to engage in discussions with stakeholders before any default is officially declared.

WeWork’s story serves as a potent reminder for businesses worldwide. While innovation and disruption are vital, they must be grounded in a sustainable business model.

“Revenue is vanity; profit is sanity.” WeWork’s journey underscores this truth, highlighting the importance of a balanced approach to growth and profitability.